(27 July 2022)

What is a recession? Up to now, economists have defined it as two

straight quarters of negative growth. But if the Biden White House has

its way, that could be changing. Tomorrow's GDP report is expected to

deliver a negative Q2 print which would fulfill the definition of a

recession since Q1 was also negative. But this week White House

officials such as Treasury Secretary Janet Yellen and even Fed Chair

Jerome Powell have suggested that the US is not in a recession and the

definition should be more flexible to account for a relatively healthy

job market. To be sure, unemployment remains under 4% although numbers

are beginning to creep higher.

(27 July 2022)

What is a recession? Up to now, economists have defined it as two

straight quarters of negative growth. But if the Biden White House has

its way, that could be changing. Tomorrow's GDP report is expected to

deliver a negative Q2 print which would fulfill the definition of a

recession since Q1 was also negative. But this week White House

officials such as Treasury Secretary Janet Yellen and even Fed Chair

Jerome Powell have suggested that the US is not in a recession and the

definition should be more flexible to account for a relatively healthy

job market. To be sure, unemployment remains under 4% although numbers

are beginning to creep higher.

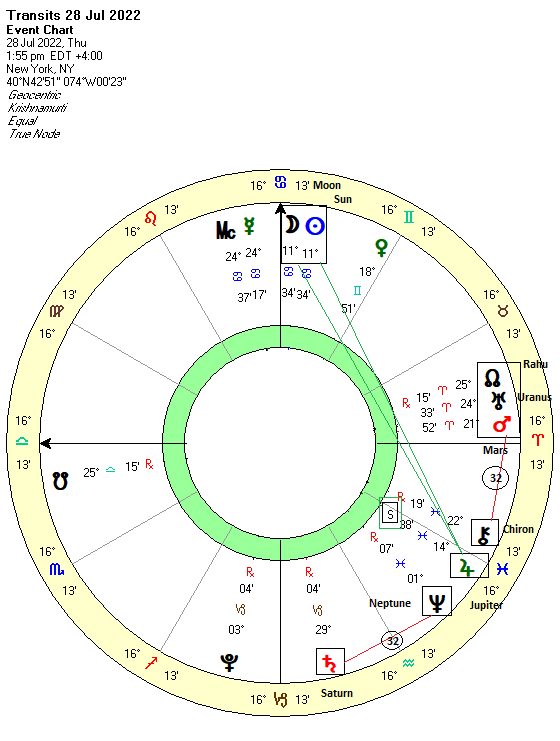

Stocks surged higher today as the Fed hinted it could pause rate hikes

if inflation shows signs of moderating. The rally was not hugely

unexpected given tomorrow's Jupiter retrograde station. Jupiter, the

most bullish planet, stations twice a year wherein its direction appears

to reverse from our perspective on the Earth. The five-day periods

around these stations can often coincide with positive market outcomes

since Jupiter's unusually low velocity increases its positive

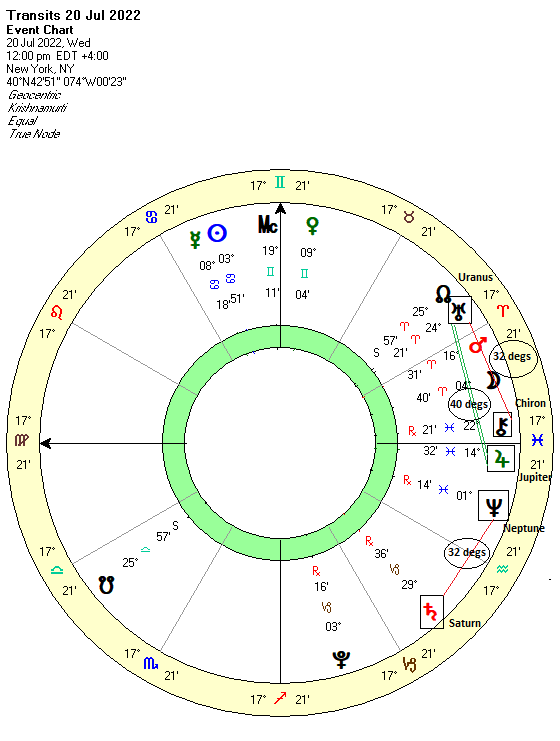

influence. As expected, we saw some early week selling on the

Mercury-Mars square but once that alignment had moved past exact late on

Tuesday, sentiment became more positive as Jupiter's energy could

shine through unimpeded.

I would note that tomorrow's New Moon aligns fairly closely with that

stationary retrograde Jupiter and therefore could well coincide with

more optimism. The Moon exactly conjoins the Sun around 2 pm EDT in

New York, while Jupiter will turn retrograde around 4.30 pm, shortly

after the close of trading tomorrow. But just to muddy the waters,

there is a bearish contraparallel due tomorrow also, as Mars (15N00)

aligns with Saturn (-15S00) and introduces the possibility of a reversal

lower, later in the day or perhaps on Friday.

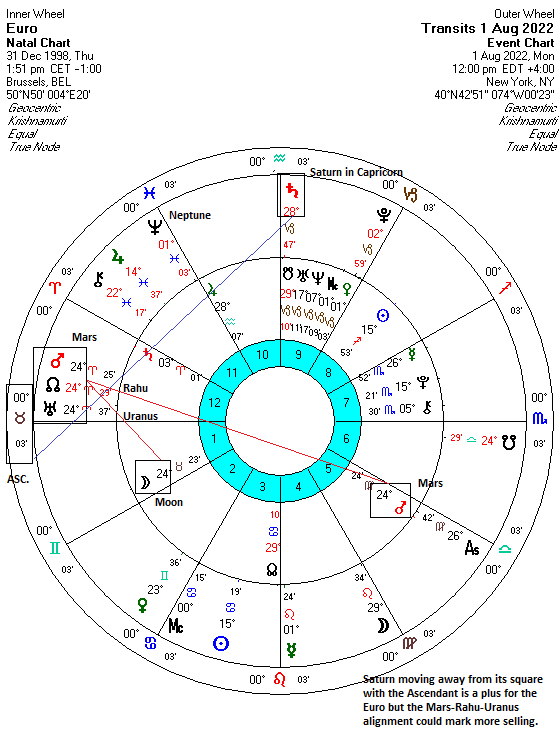

However, my attention is more focused on the triple conjunction of Mars,

Uranus and Rahu (North Lunar Node) set for Monday, August 1. On

paper, this is a nasty-looking set up involving two malefics (Mars and

Rahu) that suggests high-energy and unpredictable events which could

bring some significant troubles. While this alignment looks bad, a

quick check of the historical record shows that previous similar triple

conjunctions in January 1992 and April 2007 did not coincide with any

major market moves. And the late April 2007 alignment was actually

bullish for the market. Therefore, we should be careful not to jump to

any conclusions.

And yet there is still some downside risk associated with this triple

conjunction since the transit of Mars in particular could activate the

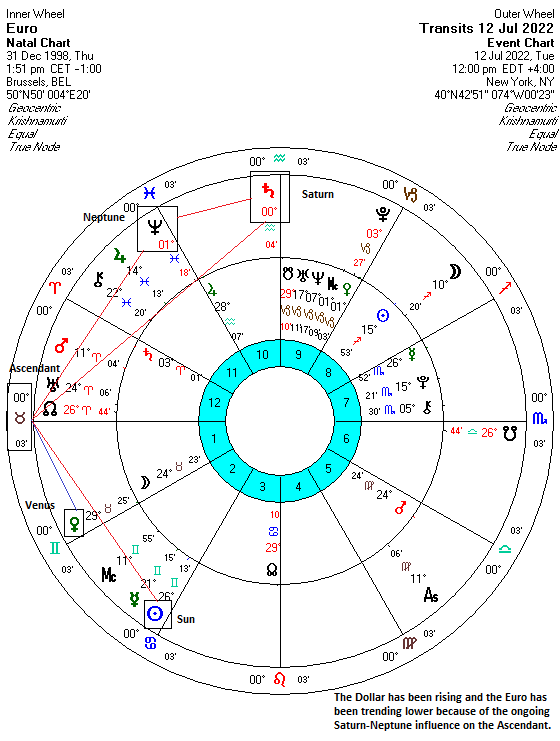

ongoing Saturn-Neptune-Uranus-Chiron alignment. As I have previously

noted, this four-planet alignment is one reason why markets have been

declining in recent months. The difficulty stems from the fact that the

Saturn-Uranus midpoint (12 Pisces) is conjunct the Neptune-Chiron

midpoint (12 Pisces). This conjunction of midpoints sets up a bearish

resonance since Saturn is the decisive negative influence amid the other

three neutral planets.

Another way of understanding this alignment is that the angular

separation of Saturn (29 Capricorn) and Neptune (1 Pisces) is 32

degrees, which is the same distance between Uranus (24 Aries) and Chiron

(22 Pisces). Since all four of these planets move very slowly, they

usually require faster-moving trigger planets to activate the other four

planets either by conjunction or by other alignments with 32 degrees

of separation. This is what happened last Friday July 22, as the

market fell by more than 1% when Mercury and Venus were separated by

the same 31-32 degrees. With Mars due to conjoin Uranus (and Rahu)

next week and thereby setting up a potential 32 degree trigger of the

larger Saturn alignment, there is good reason to be cautious. Let's

see what happens.

For more details,

.png)

.png)