(28 September 2015)

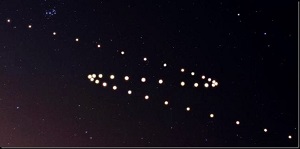

Sunday night's 'Supermoon' seems to have sparked a big sell-off across

most European and US stock markets today. The Blood Moon (or

'Supermoon') is a fairly rare celestial event that occurs when a lunar

eclipse coincides with the lunar perigee when the Moon makes its closest

approach to the Earth. The result is a bigger than normal sized full

moon that appears red in colour as the shadow of the eclipsed Earth

passes over it. It certainly makes an impressive and beautiful

nighttime display. And there is no shortage of symbolic angst and dread

attached to it, including passages from the Bible.

(28 September 2015)

Sunday night's 'Supermoon' seems to have sparked a big sell-off across

most European and US stock markets today. The Blood Moon (or

'Supermoon') is a fairly rare celestial event that occurs when a lunar

eclipse coincides with the lunar perigee when the Moon makes its closest

approach to the Earth. The result is a bigger than normal sized full

moon that appears red in colour as the shadow of the eclipsed Earth

passes over it. It certainly makes an impressive and beautiful

nighttime display. And there is no shortage of symbolic angst and dread

attached to it, including passages from the Bible. Maybe all the cultural beliefs and media hype around it merely produced a self-fulfilling prophecy as investors looked for any reason to lighten their risk. Or maybe it was another piece of empirical evidence that shows that astrology is true and there are real and measurable correspondences between the motions of the planets and life on Earth. Alas, the paradoxes in proving astrology is a problem for another day. The daily movements of markets provide better a proving ground for testing our ideas.

The Dow lost 2% on the day finishing near that crucial level of 16,000. Indian stocks were infected only briefly with the lunar malaise as the Sensex lost 1% in the afternoon closing at 25,617. The Monday declines followed a negative week last week. In last week's stock forecast, I had noted the probability of declines last week, especially towards the end of the week and the Mars-Saturn square aspect. This assessment proved to be largely true as US stocks fell throughout the week. I also noted that Monday's lunar eclipse would likely correspond with increased uncertainty. That definitely proved to be the case as European and US investors are becoming more unsure about the state of the Chinese economy as the world's economic engine is showing more signs of sputtering.

Traditionally, eclipses may have been feared because they were associated with uncertainty and interruption of the status quo, just as the light of the Sun and Moon was suddenly lost or distorted. But eclipses may also be seen as harbingers of change, either positive or negative. Some observers have suggested that stocks are more likely to reverse their direction around eclipses. One study of the effects of the perigee-apogee cycle indicated that stocks are more likely to make lows at the perigee (i.e. yesterday) and highs at the apogee. It is unknown why this might be so, although if we extrapolate from conventional symbolism we can say that the closer the Moon to the Earth, the more likely people will act in an emotional and therefore irrational manner. But this doesn't explain why collective sentiment should be negative (i.e. bearish) rather than irrationally positive, or following Alan Greenspan, irrationally exuberant.

Whatever the case may be, I do think we could say the odds of a reversal higher are somewhat greater now then they were last week. Much of this global stock market swoon over the past six weeks has been associated with Saturn's aspects. Currently, the ringed planet is getting very close to its exact alignment with Ketu, the South Lunar Node. As a general rule, the closer alignments of Saturn are more likely to mark a bottom in stock prices. Of course, transiting Saturn (6 Scorpio) is still sitting exactly opposite the natal Sun of the NYSE chart so that could make it difficult for stocks to rally. Therefore, it is a complex picture with many factors operating simultaneously. Overall, I would think we are getting closer to some kind of bottom in stock prices here, at least for the time being. As I noted last week, Saturn is due to form a close square with Neptune late November. This is a very difficult pairing of energies that should coincide with some significant declines. Whether it is a mere extension of the present decline or a separate move lower is a question which I discuss in my subscriber newsletter.

I would think that Wednesday's entry of Venus into sidereal Leo ought to bring some optimism so we could see a rebound into midweek. On the other hand, the inferior conjunction of Mercury (Rx) and the Sun on Wednesday is often negative. Its 150 degree alignment with Neptune isn't particularly inspiring either. That could well offset some of the Venus optimism. Friday's Mercury-Mars alignment also looks a bit tense. So the short term aspects this week look both choppy and volatile. The longer term aspects continue to look bad, however.