Even if the CBO is correct and US government runs out of money later in the month of June, markets are nonetheless focused on Thursday, June 1 as a critical date. If a deal is not reached by then, we should expect much more market turbulence as investors reassess their risk and reallocate their capital in light of this new uncertain terrain.

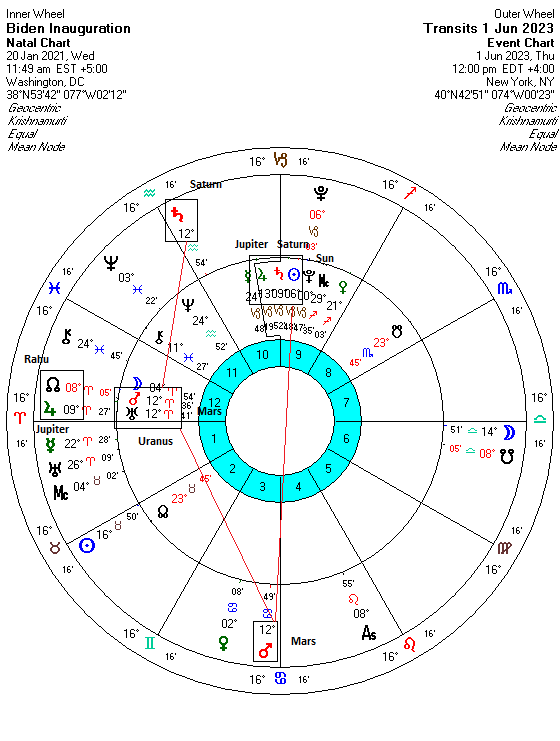

A useful astrological perspective on this situation considers the Inauguration horoscope of President Joe Biden. The Inauguration chart for Jan 20, 2021 reflects the ups and downs of his both administration and the country according to the dominant transit influences at any given time. Currently, we can easily see why stress levels are no doubt rising in the White House. Transiting Mars is now opposite the 10th house alignment of the Sun (6 Capricorn), Saturn (9 Cap) and Jupiter (13 Cap). Since Mars is the planet of frustration, conflict and anger, it is not surprising that negotiations between Joe Biden and GOP Speaker Kevin McCarthy have not shown much progress. In recent days, Mars (6 Cancer) was exactly opposite the natal Sun and transiting Pluto at 6 Capricorn. Mars (conflict) was in a tense alignment with the Sun (government, leaders) and Pluto (power, coercion).

By next Thursday, Mars will be closely opposite Saturn (institutions, tradition) and Jupiter (justice, prosperity). On the face of it, this is not a good combination for a last-minute debt ceiling deal before June 1. One might think that we merely have to wait until Mars is past its exact opposition with Jupiter on June 2 for a deal to be struck to avert a default. That view actually makes good sense but the position of Saturn raises questions about the presence of a more significant obstacle.

Transiting Saturn (12 Aquarius) is now casting its full-strength 3rd house/60 degree aspect to the Mars-Uranus conjunction in the Inauguration chart. This is a very stressful combination that suggests a protracted period of conflict and frustration. Since Mars-Uranus also carries a military and violent symbolism, there is a higher risk of some noteworthy military actions taking place in the coming weeks. The Saturn transit is particularly troublesome here since it is slowing down ahead of its retrograde station on June 17. This means that its alignment with Mars and Uranus will be extended for several weeks through the entire month of June and even into July.

In fact, stress levels are likely to rise further next week since transiting Mars (12 Cancer) will aspect Saturn (12 Aquarius) by its most malefic 8th house/210 degree aspect. In this way, the Mars-Saturn aspect will activate the Mars-Uranus conjunction and the natal Jupiter at the same time.

What could this mean? If it were only Mars afflicting planets in the natal chart, we would expect the usual 11th hour deal before any serious damage is done. But the presence of Saturn here also suggests this situation could be more serious. If Mars is the trigger, It could still resolve fairly quickly after June 2, but the damage to national credibility may be more severe. While an outright default seems impossible, this double affliction by Mars and Saturn in the Inauguration chart alerts us to the possibility of the situation getting worse than many expect.

For more details, check out my weekly subscriber newsletter which is published every Sunday. In addition to reviewing the key planetary and technical influences on US and Indian stocks for the short and medium term, I also provide an astrological analysis of potential upcoming moves in currencies, gold and oil.

These updates are usually posted midweek. You can be notified of new posts by following me on Twitter.