(22 July 2021)

It seems the pandemic is not going to end any time soon. The spread

of the Delta variant in many countries has dampened hopes for a quick

re-opening this summer. More countries are being forced to make

difficult choices between re-opening and trying to limit new infections

despite increasing numbers of vaccinations. Since unvaccinated people

are vulnerable to infection by the more transmissible Delta variant,

hospitals may come under renewed stress in the near term.

(22 July 2021)

It seems the pandemic is not going to end any time soon. The spread

of the Delta variant in many countries has dampened hopes for a quick

re-opening this summer. More countries are being forced to make

difficult choices between re-opening and trying to limit new infections

despite increasing numbers of vaccinations. Since unvaccinated people

are vulnerable to infection by the more transmissible Delta variant,

hospitals may come under renewed stress in the near term.

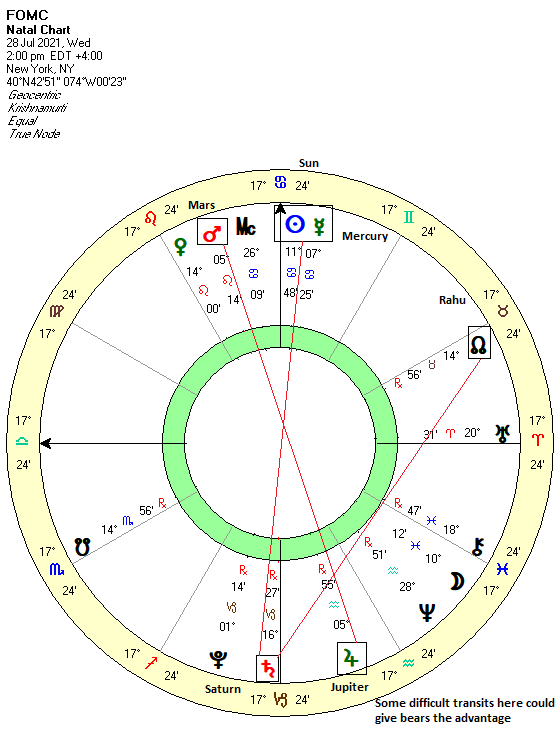

The new global increase of infections complicates matters for the Fed as

it looks towards its next FOMC meeting on Wednesday, July 28. The

Federal Reserve is keen to address recent inflationary pressures,

however "transitory" they may be. A growing number of Fed governors

are looking towards tapering their QE purchases of assets later this

year in an attempt to cool off the red hot housing market in the US.

Observers were therefore looking at this upcoming meeting for a possible

change in language on tapering, including clues for when tapering may

begin.

However, the new surge of infections in the US, UK and many other

countries suggest that re-opening is not a done deal. While growth may

be returning for now, additional lockdowns are possible, along with

their attendant suppression of economic activity. The problem here is

that a tighter Fed that is tapering asset purchases may suddenly be out

of step with a fourth summer Covid wave that would put the economy on

its heels once again.

Markets are now showing signs of unease with the implications of the

Delta variant as volatility has increased in recent days. The multi-day

pullback coincided with the entry of Mars into Leo and its subsequent

alignment with Pluto. The midweek rebound appeared to reflect a more

favourable alignment of the Sun, Venus and Jupiter.

But the outlook is quite uncertain next week as Mars is due to oppose Jupiter on Thursday, just one day after the FOMC meeting. Mars-Jupiter oppositions occur once every two years and tend to be bearish in their effects. However, it is important to note that possible negative effects may not manifest on the exact day of the opposition but may be spread out in the days prior and (more likely) following the opposition. The previous Mars-Jupiter opposition occurred on May 5, 2019 and coincided the start of the 7% decline in US stocks. Before that, Mars opposed Jupiter on Feb 27, 2017. However, on this occasion stocks went most sideways, both before and after opposition.

Mars also opposed Jupiter on Jan 1, 2015 and marked the start of a 5% decline in stocks. Preceding that, Mars opposed Jupiter on Oct 28, 2012 just days before stocks fell 3%. And before that, the Mars-Jupiter opposition on Aug 4, 2010 coincided with the start of a 7% pullback.

So while the Mars-Jupiter opposition is not always bearish in its effects -- either immediate or proximate -- there is a distinct tendency for pessimism around that time. As a malefic planet, Mars tends to undermine confidence and optimism, which is represented by Jupiter. Therefore, the fact that the Mars-Jupiter opposition occurs the day after next week's FOMC meeting suggests a greater probability of a negative market reaction to the Fed decision.

For more details,