(12 November 2018)

It's that time again. Mercury is due to station retrograde later this

week on Friday, November 16. Even among the

non-astrologically-inclined, most people have heard of Mercury

retrograde. They know it connotes something bad or unexpected, and

that things are more likely to go haywire during the three-week period

when it moves backwards in the night sky. As the mythological winged

messenger, Mercury symbolizes communication, commerce, transportation

and rational thought, among other things.

(12 November 2018)

It's that time again. Mercury is due to station retrograde later this

week on Friday, November 16. Even among the

non-astrologically-inclined, most people have heard of Mercury

retrograde. They know it connotes something bad or unexpected, and

that things are more likely to go haywire during the three-week period

when it moves backwards in the night sky. As the mythological winged

messenger, Mercury symbolizes communication, commerce, transportation

and rational thought, among other things. When Mercury is moving in normal direct motion, it is believed that there is a greater likelihood for things to work out as planned. But every four months or so, it stations retrograde (Rx) and appears to move backwards across 15-18 degrees of arc. This departure from its normal motion conjures up images of hassles, delays, technical breakdowns, computer viruses and the like. The most famous Mercury Rx station in recent times was election night in the US in November 2000 which produced the unprecedented Bush-Gore stalemate. The election outcome was undecided until it was settled finally in the Supreme Court a month later.

One of the best ways to see how Mercury retrograde may (or may not) be working, is to look at how the stock market performs during its Rx periods. The theory holds that stocks should be less positive and more vulnerable to declines, either through actual malfunctions in the stock exchange, or more commonly through misunderstandings and unexpected news in the economic data that traders rely on for their buy or sell decisions. So we can ask: is Mercury retrograde really bearish for stocks?

In my view, Mercury retrograde is only one factor out of many and is less likely to be decisive. Other alignments may override its influence, although I suspect it has a negative bias. It is similar to the Venus retrograde periods in that respect. They don't always correlate with declines, but the downside risks rise during the Rx period.

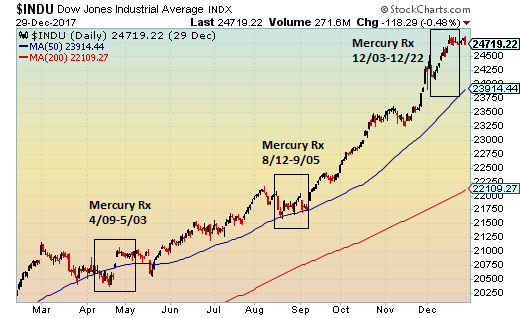

I haven't done an exhaustive study by any means but I did want to present some recent Mercury Rx history here. As these two charts for 2017 and 2018 show, each Mercury retrograde period has featured at least one dip, typically near the beginning of its retrograde period. It doesn't appear to strongly correlate with an overall negative performance although that may happen in some situations where other bearish patterns are in play.

The April 2017 period was modestly bearish for the first week or two after the Rx station but stocks recovered and pushed higher by the time Mercury resumed its forward motion in May. The August-September 2017 Rx period was more bearish as the Dow fell soon after the station and didn't recover. The December 2017 Rx period was quite bullish actually, although we should note that stocks fell for a few days immediately following the Rx station.

The March-April 2018 period was bearish to start and marked the important April 2nd low for the stock market. Prices rebounded by the end of the Rx period, however. The July-Aug 2018 period was more bearish, perhaps as stocks reversed lower immediately after Mercury turned retrograde on July 26th. While stocks rebounded by the end of the period, it was generally negative.

And that brings up to the next period from November 16 to December 7. Stocks are down sharply already in the US today (Monday). I think this negative bias is likely to continue this week as the Rx period gets closer. This is less to do with Mercury turning retrograde than the fact that it will square Neptune later this week. This is a pretty bearish set up.

But if recent Rx periods are any guide, then we are likely to see stocks experience at least one significant pullback after Friday, the 16th and before December 7th. Between the Mercury retrograde period, its Neptune square, and negative alignments of Mars this week, the midterm election rebound is looking quite fragile at the moment. A retest of the October low seems more likely than not.

For more detailed market analysis, please check out my weekly subscriber newsletter. It is published every Saturday and covers US and Indian stocks, as well as currencies, gold and oil.