(14 July 2013)

Ben Bernanke has once again proved that the Fed is the stock market's

best friend. The Fed Chair's magic words that the zero interest rate

policy would remain in place indefinitely put investors in a buying mood

as the worrisome taper talk faded into the background. No doubt

Bernanke was still in damage control mode after his June musings about

reducing bond buying created a headlong rush to the exits. While

financial markets are certainly relieved that the Fed's free money will

continue to flow, one wonders how long it can last. The Fed's

experimental stimulus plan (QE) is now into its 4th year and has boosted

stocks and other financial assets around the world in the wake of the

financial meltdown of 2008.

(14 July 2013)

Ben Bernanke has once again proved that the Fed is the stock market's

best friend. The Fed Chair's magic words that the zero interest rate

policy would remain in place indefinitely put investors in a buying mood

as the worrisome taper talk faded into the background. No doubt

Bernanke was still in damage control mode after his June musings about

reducing bond buying created a headlong rush to the exits. While

financial markets are certainly relieved that the Fed's free money will

continue to flow, one wonders how long it can last. The Fed's

experimental stimulus plan (QE) is now into its 4th year and has boosted

stocks and other financial assets around the world in the wake of the

financial meltdown of 2008. The trouble now is that the Fed may be trapped. Markets have become addicted to the $85 Billion of treasuries it buys every month so that any hint that this money will not be forthcoming causes investors to freak out. This is what happened in June when Bernanke suggested that bond purchases would be tapered if the economy continued to recover. With every bond buy, the Fed's balance sheet becomes that much more indebted as even invented money still leaves a trail of red ink.

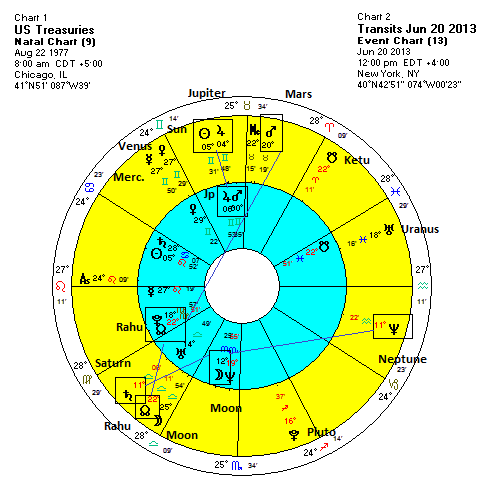

We can see how Bernanke's tapering comments on June 19 may have been reflected in some close aspects in the first trade horoscope of US Treasuries (Aug 22 1977). The Sun-Jupiter conjunction had conjoined the natal Jupiter suggesting a kind of maximum faith and trust (Jupiter) which would then be increasingly subject to deterioration. The exact aspect therefore introduces new vulnerabilities as the favorable energy begins to wane. Both Saturn (11 Libra) and Neptune (11 Aquarius) were in a stressful alignment with the Moon (12 Scorpio) which can symbolize erosion and weakness (Neptune) and negativity (Saturn). Mars (20 Taurus) and Rahu (22 Libra) were also in close aspect with natal Rahu (22 Virgo) suggesting sudden and abrupt developments (Mars) that caused disruption (Rahu) in the status quo.

How long can the Fed go on buying bonds in this way? To be sure, it can do it for a long, long time since the US Dollar is the world's reserve currency and the rest of the world still regards the US as the main driver of the global economy. Eventually, the debt will become so large that non-Fed buyers of US debt will start to demand a premium as the risk of default rises. Bond yields will then move higher and the Fed will lose control of the market. As we know, higher interest rates tends to depress economic activity and could spark another major recession. So it may be a question of when the day of reckoning will come. If Bernanke goes ahead with the taper in late 2013 and early 2014, the stock market decline and subsequent economic recession could come next year. But if he keeps the QE program is in place longer, Bernanke can delay the inevitable, assuming the bond market keeps its trust in US debt. The current bubble in asset prices will remain in place as long as interest rates remain low, say below 3% on the 10-year treasury note.

Bernanke's jawboning generally boosted stocks across the board last week. US markets rose by almost 3% as the Dow closed at an all-time record of 15,464. Indian stocks also climbed about 3% for the week as the Sensex finished at 19,958. I thought we might have seen more downside in the early week on Tuesday's Sun-Mercury conjunction and the Saturn station on Monday. Indian stocks were more tentative in the early week, although the US market drifted higher.

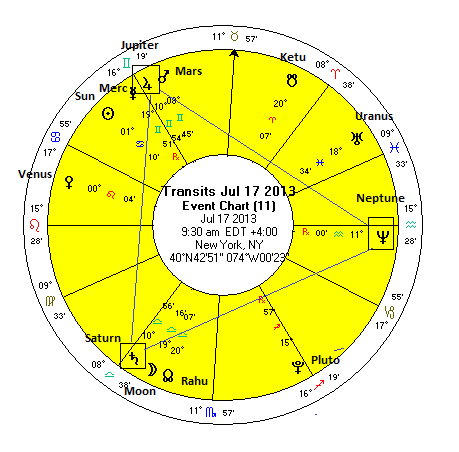

It seems that the current up trend is linked to the approach of Jupiter's exact aspect with Saturn and Neptune. Jupiter is typically a bullish influence and its 120 degree aspect to Saturn and Neptune does broadly fit with the recent rally. This aspect will be closest on Wednesday this week after which Jupiter will begin to separate. This will tend to reduce the extent of optimistic sentiment and could coincide with some sober second thoughts amidst the risk-free euphoria engendered by Bernanke's policies. Saturn's upcoming conjunction with Rahu, the North Lunar Node, in September is another potential obstacle for the financial markets.